flow through entity canada

Accounting for flow-through shares with attached share purchase warrants To help clarify this issue this document also includes a practical and detailed example of a publicly traded Canadian mining entity involved in issuing flow-through shares to investors. MONTREAL--BUSINESS WIRE--Jul 25 2022--Lomiko Metals Inc.

This may be more tax efficient.

. Each FT Unit consists of one. A flow-through entity is also called a pass-through entity. A pass-through entity also called a flow-through entity is a type of business structure used to avoid double taxation.

Flow Through Entities Owned by Residents of Canada In the United States certain business entities such as Limited Liability Companies LLC or subchapter S corporations are flow through entities where the entity does not pay tax but where the net income and other tax results flow through to the members or shareholders on a pro rata basis. At that time the Canadian government introduced provisions to allow for. However for US tax purposes ULCs may be considered flow-through entities ie the ULC is disregarded and the earnings of the ULC are flowed through to the ultimate owners of the ULC.

However for US tax purposes ULCs may be treated either as partnerships or check-the-box flow-through entities possibly offering cross-border opportunities Branch permanent establishment. Flow-through entities are considered to be pass-through entities. The basic principle behind flow-through shares which are unique to the resource sector in Canada is that a mining corporation willing to forego the tax benefit of certain CEE and CDE amounts that it incurs can renounce these expenditures to investors buying shares in the corporation in certain circumstances.

A legitimate business entity that passes income to owners or investors of the business is a flow-Through entity. All of the following are flow-through entities. Flow-Through Entities in Canada Domestic Perspective 21.

Deemed Canadian Exploration Expense DCEE is a CDE that is renounced as CEE under subsection 66 12601. Flow-through entities are used for several reasons including tax advantages. Income that is or is deemed to be effectively connected with the conduct of a US.

Flow-through shares FTSs On July 10 2020 the Government of Canada announced changes to protect jobs and safe operations of junior mining exploration and other flow-through share issuers by extending the timelines for spending the capital they raise via flow-through shares by 12 months. Overview and the basic situation Since 1972 and subject to the changes now being phased in as discussed below Canadian-based busi-ness enterprises and undertakings carried out in corpo-rate form have resulted in a modified classical double tax. A flow-through entity is a legal business entity that passes any income it makes straight to its owners shareholders or investors.

Flow-through warrant FTW a FTW includes a right of a person to have a FTS issued to that person pursuant to the FTS subscription agreement. An investment corporation a mortgage investment corporation a mutual fund corporation a mutual fund trust a related segregated fund trust a partnership. Understanding What a Flow-Through Entity Is.

The trust is resident in Canada investments in the trust are listed or traded on a stock exchange or other public market. Flow-through shares have helped expand Canadas resource sector since their introduction to the Canadian tax system in 1954. Though ULCs are taxed as corporations in Canada they are eligible for check-the-box election in the United States and may be taxed as either a corporation or a flow-through entity.

You are a member of or investor in a flow-through entity if you own shares or units of or an interest in one of the following. Flow Through Entity has the meaning set forth in Section 34C hereof. This tax treatment may be useful since the income of the ULC may be consolidated with that of its US parent for US tax purposes.

Flow-through entities - Canadaca Flow-through entities This section provides information on the types of investments that are considered flow-through entities and how to calculate the capital gain and loss resulting from the disposition of shares of or interests in a flow-through entity. Flow-through limited partnerships are valuable to investors who have current income that will be taxed at the highest marginal rate. LMR Lomiko Metals or the Company announces the Company received TSX-V approval and has closed its private placement and issued 9765400 flow-through units the FT Units at a price of 0065 per FT Unit for aggregate gross proceeds of 634751.

A specified investment flow-through SIFT trust is one other than a real estate investment trust for a tax year or an excluded subsidiary entity that meets all of the following conditions at any time during a tax year. What is a flow-through entity. Trade or business of a flow-through entity is treated as paid to the entity.

Investment Tax Credit ITC is defined in subsection 127 9. The flow-through share regime is designed to provide an incentive for financing qualifying exploration ventures in Canada and effectively shift the tax deduction from the company doing the exploration to the purchasers of the flow-through shares Mr. Federal income tax purposes or subject to treatment on a comparable basis for purposes of state local or foreign tax law.

Typically businesses are subject to corporate tax while business owners also have to pay a personal income tax. Flow Through Entity means an entity that is treated as a partnership not taxable as a corporation a grantor trust or a disregarded entity for US. This rule applies for purposes of Chapter 3 withholding and for Form 1099 reporting and backup withholding.

A foreign partnership. A common misconception is that flow-through shares are a special class of equity. Flow-through entities are different from C corporations they are subjected to single taxation and not double taxation.

This means that the flow-through entity is responsible for the taxes and does not itself pay them. These entities are generally used by foreign investors to gain advantageous tax treatments in their home jurisdiction. For Canadian income tax purposes ULCs are treated as regular corporations subject to Canadian tax on their worldwide income.

In the end the purpose of flow-through entities is the.

How To File Self Employed Taxes In Canada

Elective Pass Through Entity Tax Wolters Kluwer

An Introduction To The Use Of Blocker Corporations In M A Transactions Frost Brown Todd Full Service Law Firm

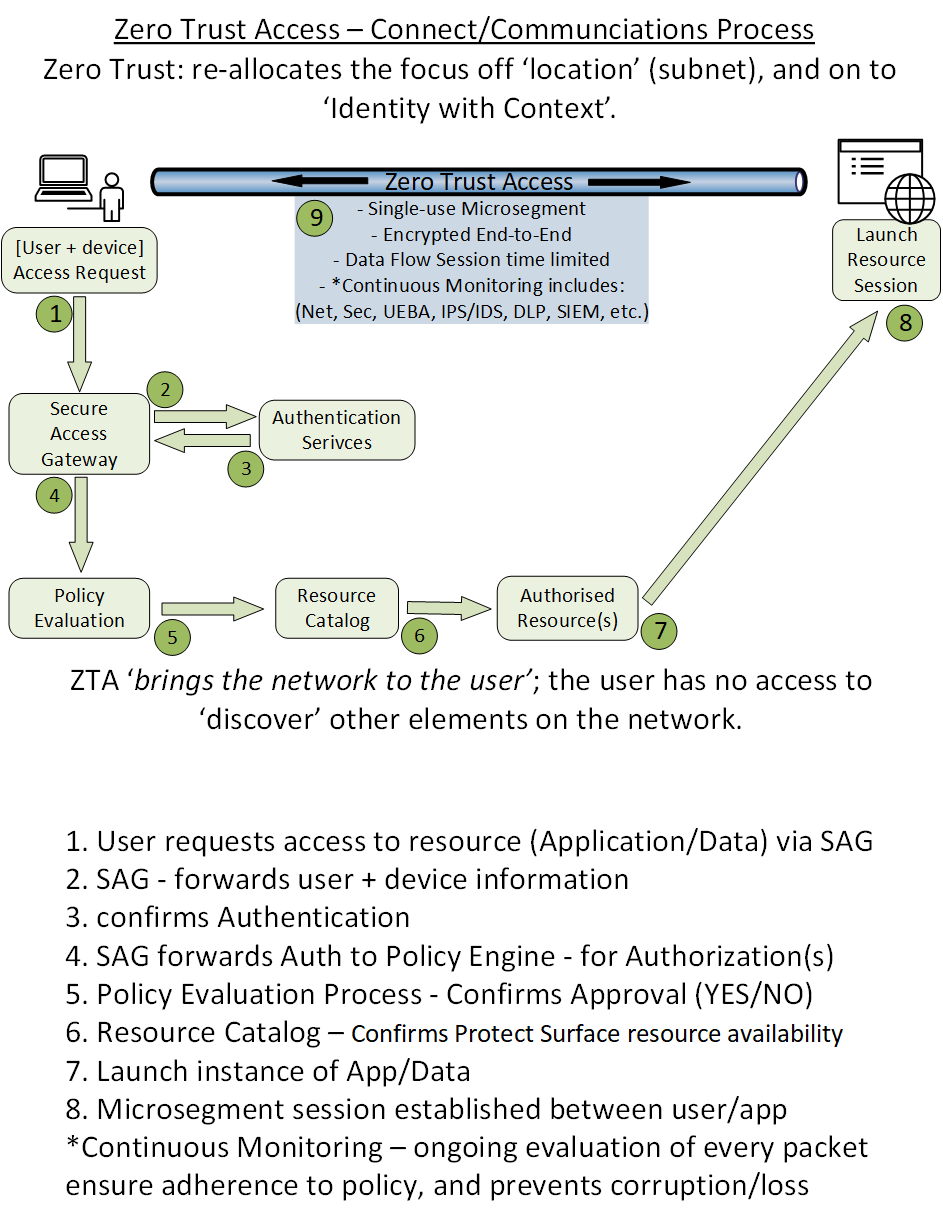

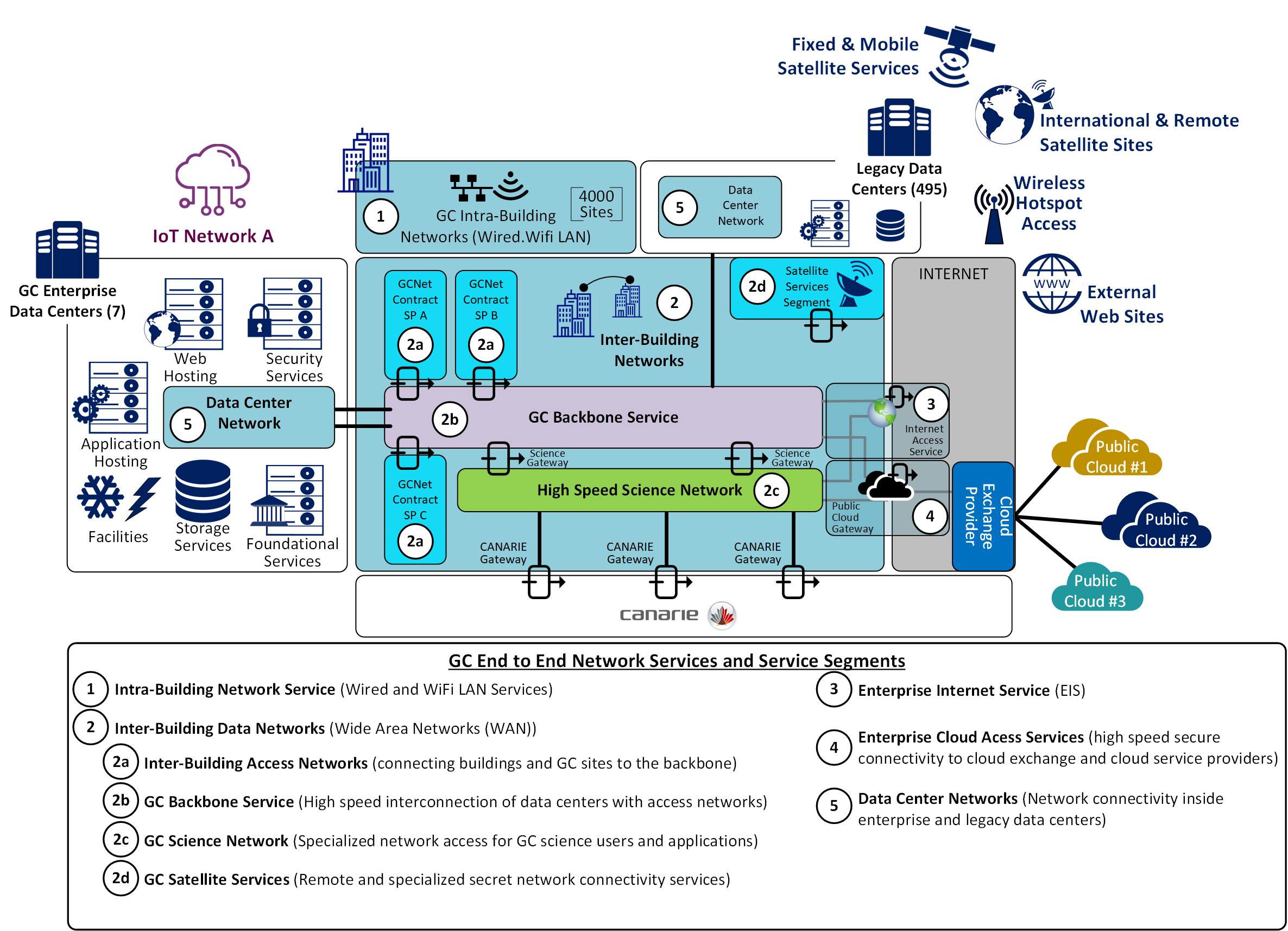

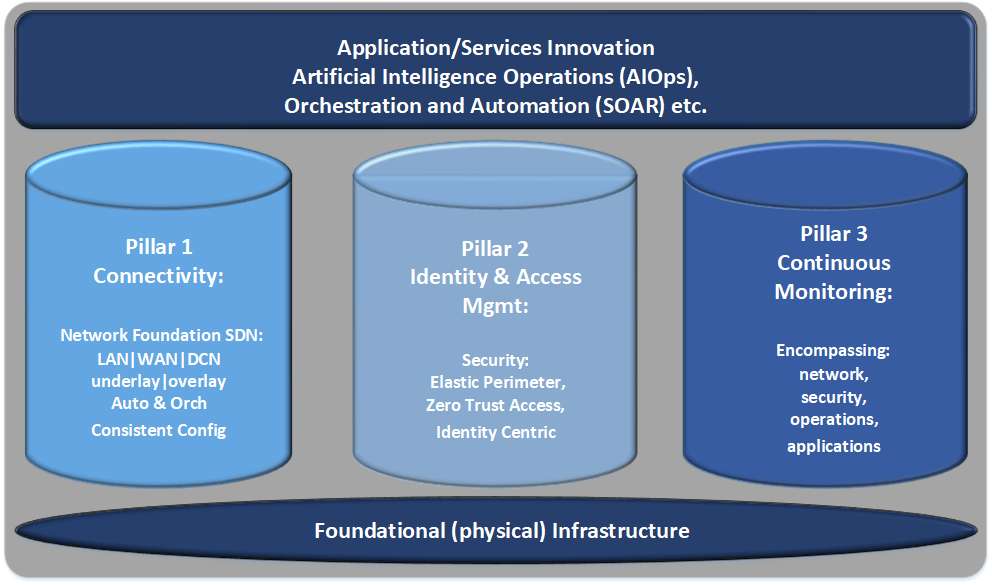

Network And Security Strategy Canada Ca

Network And Security Strategy Canada Ca

New York Pass Through Entity Tax Deloitte Us

S Corporations In Canada Madan Ca

Us Expats In Canada Taxes Advanced American Tax

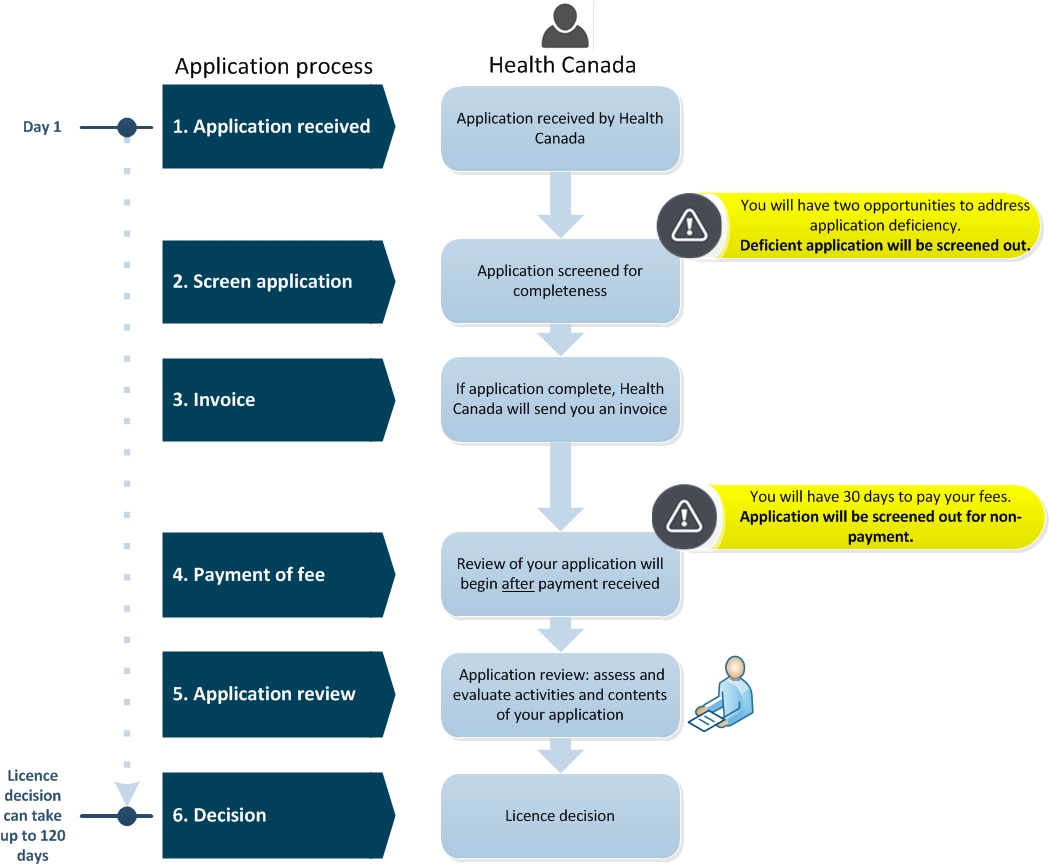

Frequently Asked Questions Medical Device Establishment Licensing And Fees Canada Ca

Elective Pass Through Entity Tax Wolters Kluwer

Network And Security Strategy Canada Ca

The Building And Stabilization Of An Archean Craton In The Superior Province Canada From A Heat Flow Perspective Jaupart 2014 Journal Of Geophysical Research Solid Earth Wiley Online Library

Network And Security Strategy Canada Ca

The Building And Stabilization Of An Archean Craton In The Superior Province Canada From A Heat Flow Perspective Jaupart 2014 Journal Of Geophysical Research Solid Earth Wiley Online Library

Dpdf19 Bizfilings 5 Steps To Forming Entity Infographic Business Owner Infographic Operations Management

Underused Housing Tax More Exclusions Coming Kpmg Canada