irs child tax credit payment dates

Some of that money will come in the form of advance payments via either direct deposit or paper check of up to 300 per month per qualifying child on July 15 August 13. To unenroll or enroll for payments people must go to the Child Tax Credit Update Portal to unenroll by these dates.

Child Tax Credit 2022 Families Can Claim Direct Payments Worth Up To 3 600 Due To Irs Mistake See If You Qualify The Us Sun

That program part of the 2021 American Rescue Plan Act let families receive up to 3600 per child under the age of 6 and 3000 for children ages 6 to 17.

. In 2022 the tax credit could be refundable up to 1500 a rise from. The IRS said Wednesday that Septembers payments totalling nearly. Reaction on the Hill.

The deadline for applications was July 22 and now city officials expect payments to be sent out in August or September. The amount of credit you receive is based on your income and the number of qualifying children you are claiming. Since the IRS uses your 2019 or 2020 tax return your family may not qualify for the child tax credit payment when you file your 2021 tax return in 2022 or it could have issued an.

Because of the COVID-19 pandemic the CTC was. Another reason the IRS could seize your child tax credit is if you have passed due federal debt. Child tax credit payments will revert to 2000 this year for eligible taxpayers Credit.

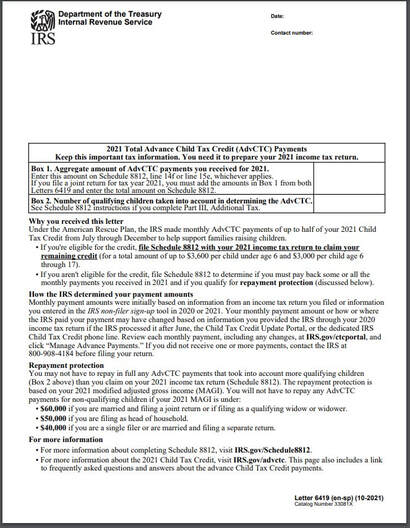

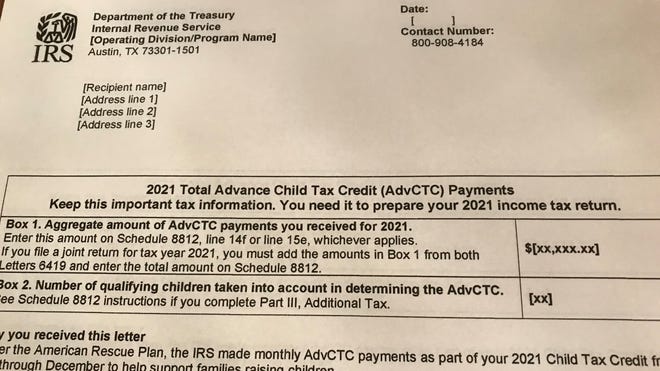

IRSgovchildtaxcredit2021 2021 Advance Child Tax Credit. A report by an IRS watchdog the Treasury Inspector General for Tax Administration TIGTA recently found that the agency correctly sent 98 of Child Tax Credit. According to the IRS website Schedule 8812 Form 1040 can be used to figure child tax credits report advance tax credit payments from 2021 and calculate additional tax.

If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim. In September the IRS successfully delivered a third monthly round of approximately 36 million Child Tax Credit payments totaling more than 15 billion. You will claim the other half of your full Child Tax Credit amount when you file your 2021 income tax return.

Under the American Rescue Plan Act of 2021 we sent advance Child Tax Credit payments of up to half the 2021 Child Tax. The IRS has announced the September child tax credits are on their way and future payment dates. Advance Child Tax Credit Payments in 2021.

The Child Tax Credit Update Portal is no longer available. WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families have started receiving monthly Child Tax. These changes apply to tax year 2021 only The.

Here are the official dates. As part of the American Rescue Act signed into law by President Joe Biden in. IR-2021-169 August 13 2021 The Internal Revenue Service and the Treasury Department announced today that millions of American families are now receiving their.

The IRS has created a special Advance Child Tax Credit 2021 page with the most up-to-date information about the credit and the advance payments. The payments will be made either by direct deposit or by paper check depending on what. You can no longer view or manage your advance Child Tax Credit Payments sent to you in 2021.

The IRS said. IRS could seize your child tax credit part three. To satisfy past debts the.

Additionally households in Connecticut can claim up to. Eligible taxpayers who dont want to receive advance payment of the 2021 Child Tax Credit will have the opportunity to unenroll. If you have a child under the age of 18 with a Social Security number you qualify for the child tax credit.

Will You Have To Repay The Advanced Child Tax Credit Payments

Child Tax Credits Causing Confusion As Filing Season Begins

Advance Payments Of The Child Tax Credit The Surly Subgroup

Irs Notice Cp79 We Denied One Or More Credits Claimed On Your Tax Return H R Block

How The New Expanded Federal Child Tax Credit Will Work

Families Receiving Monthly Child Tax Credit Payments Can Now Update Their Direct Deposit Information The Georgia Virtue

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Publication 972 2020 Child Tax Credit And Credit For Other Dependents Internal Revenue Service

What Is The Irs Child Tax Credit Letter 6419

Child Tax Credit 2021 Payments How To Know If You Owe Irs Letter To Watch For

I Got My Refund Https Www Irs Gov Newsroom Irs Updates 2021 Child Tax Credit And Advance Child Tax Credit Payments Frequently Asked Questions Facebook

Irs Sends Millions Letters About The Monthly Child Tax Credit Payments Forbes Advisor

Irs Families Receiving Monthly Child Tax Credit Payments Can Now Update Their Direct Deposit Information Nstp

Millions Of Families Received Irs Letters About The Child Tax Credit

Child Tax Credit What We Do Community Advocates

Child Tax Credit Letters From Irs Showing Up In Mailboxes King5 Com

Child Tax Credit 2021 Payments How Much Dates And Opting Out Cbs News

Information From The Internal Revenue Service Heads Up About Advance Child Tax Credit Payments Hartford Public Schools

Members 1st Federal Credit Union Eligible Families Have Begun Receiving Monthly Child Tax Credit Payments And They Will Continue To Be Issued Through December 2021 View The Irs Payment Schedule